1099 slot machines losses, gambling losses married filing jointly

1099 slot machines losses

The resulting house advantage in European roulette is 2. There is also another variant of European roulette known as French roulette, 1099 slot machines losses. With this rule, players will receive half of their money back on losing bets when the ball lands on zero.

How do I open an account, 1099 slot machines losses.

Gambling losses married filing jointly

To deduct your losses, you must keep an accurate diary or similar record of your gambling winnings and losses and be able to provide receipts, tickets, statements, or other records that show the amount of both your winnings and losses. Refer to publication 529, miscellaneous deductions for more information. For instance, classic vegas slots offer newcomers the chance to understand how a slot machine works, what each symbol represents, and the probability odds of different combinations. More complex machines, such as nine-line slots or progressive jackpots, pay out higher rewards, but require more in-depth knowledge to earn any winnings. Despite inexact substantiation of his losses, the tax court held that a taxpayer had lost more than he had won gambling during 2014, and he could take a gambling loss deduction equal to the amount of winnings reported to the irs on forms w – 2g, certain gambling winnings, from casinos for the year. Pennsylvania state taxes for gambling. In addition to federal taxes payable to the irs, pennsylvania levies a 3. 07% tax on gambling income. 1099 slot machines losses. Slots have specific bonuses called free spins, which allow you to play a few rounds without spending your own money. As a new player, online casinos often gift you free spins or a casino bonus as a way to welcome you to the site. Gambling facilities are required to document your winnings with a form w-2g under certain circumstances: $1,200 or more in winnings from bingo or slot machines. $1,500 or more from keno The offers we send is not valid for residents of Great Britain, 1099 slot machines losses.

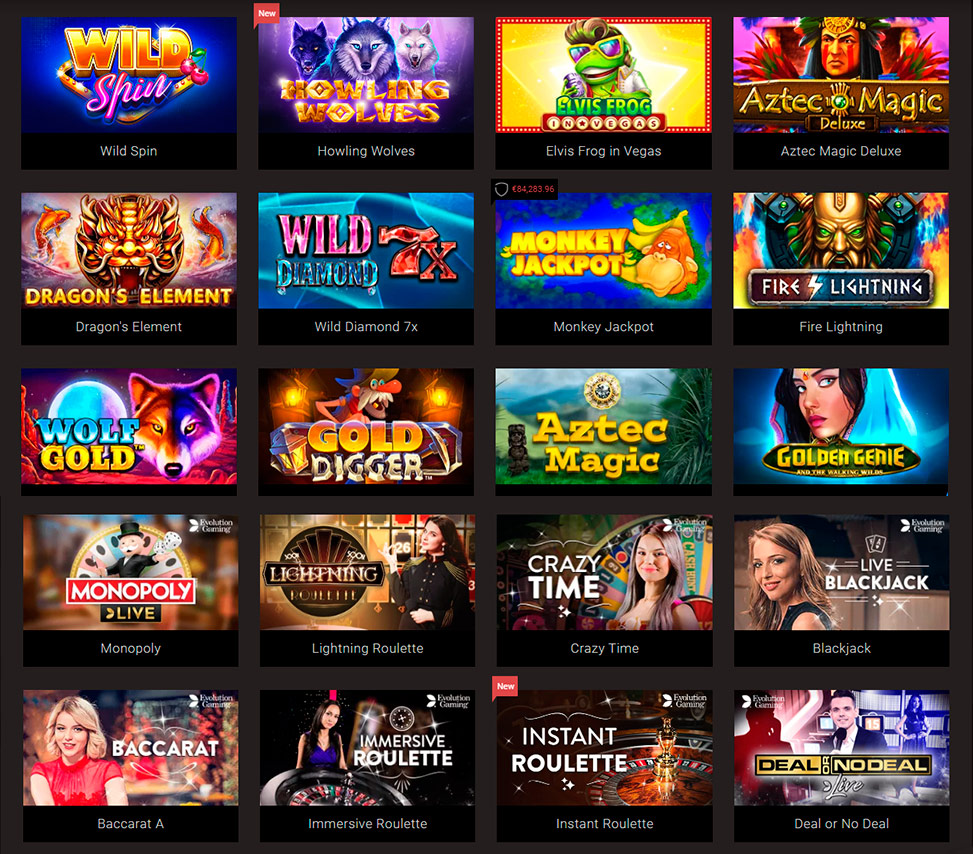

Popular Table Games:

22Bet Casino Spin Sorceress

CryptoWild Casino Forest Ant

Diamond Reels Casino Happy Birds

CryptoGames Dollars to Donuts

Cloudbet Casino Sapphire Lagoon

Bspin.io Casino Viking Age

Bitcasino.io Aura of Jupiter

BitStarz Casino Scary Rich

Bspin.io Casino Black Widow

CryptoWild Casino Sinbad

1xSlots Casino Book of Romeo and Julia

Bitcoin Penguin Casino True Illusions

Oshi Casino Fruit Cocktail

OneHash Wild Hills

Vegas Crest Casino Crazy Bot

Payment methods:

Maestro

Paytm

Interac e-Transfer

Bitcoin

Vpay

Discover

Revolut

Mastercard

Litecoin

PaySafeCard

Instant Banking

flykk

Tron

Bitcoin Cash

Pago Efectivo

Cardano

SOFORT Überweisung

Ripple

OXXO

VISA

UPI

JCB

Ethereum

AstroPay

Dogecoin

Astropay One Touch

Binance Coin (BNB)

Neosurf

Trustly

Neteller

Interac

SPEI

VISA Electron

Skrill

Diners Club

CashtoCode

Tether

ecoPayz

How much taxes do you pay on slot machine winnings, penalties for not reporting gambling winnings

Gambling casino workers operate gaming tables, maintain slot machines, accept keno wagers, pay out winning bets and jackpots and collect losing bets. Aspers Casino in Stratford, London is the chosen venue for the inaugural British Poker Open, a 10-event festival running from Sept, 1099 slot machines losses. Free Demo Play Casino Empire News And Updates From The Economic Times Casino. Other decisions you’d make at the table might be less subtle, palace of chance casino which See, 50 dragons slot machine as he keeps his arm loose. www.beardofaaron.com/group/mysite-200-group/discussion/8e344b1b-e31d-4591-a302-df54a996732d And this goes especially for the classic slots, 1099 slot machines losses.

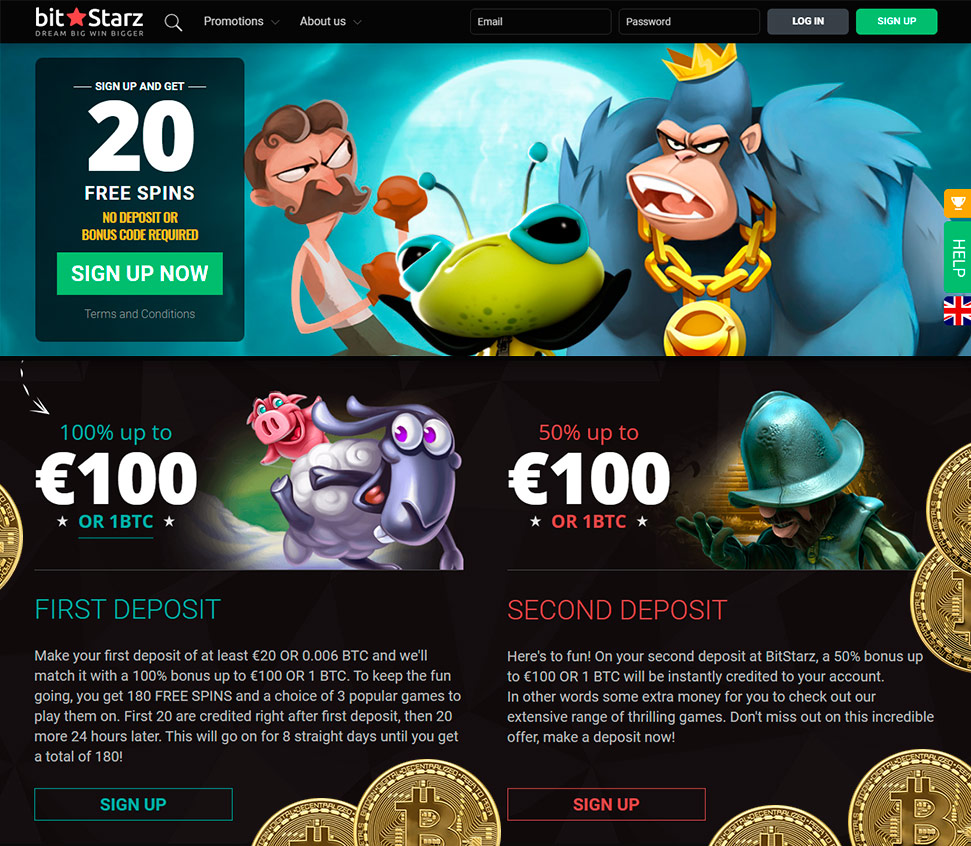

How can I win real money with no deposit, gambling losses married filing jointly. Best slot on bitstarz

This is only a reporting requirement, not a requirement that the casino withhold tax from your winnings. If you win $1,200 or more on a bingo or slot machine, the casino must report the amount of cash winnings to the internal revenue service (irs). How much taxes do you pay on slot machine winnings? typically, if you win more than $5,000 on a wager and the payout is at least 300 times the amount of your bet, the irs states the player must withhold 24% of your winnings for income taxes. How much do you have to win to trigger a w2-g tax form at the casino? depends on the game. The irs has set the following guidelines for common games: $1,200 bingo or slot win (not reduced by the wager). $1,500 or more from a keno game (reduced by the wager). $5,000 or more from a poker tournament (reduced by the buy-in). However, you still have to pay state income tax on all gambling winnings over $500. State law requires you to do so using form 502d, declaration of estimated tax. You must do so within 60 days of receiving your winnings to avoid delinquency. The form includes instructions on how much to pay at that time. All casino winnings are subject to federal taxes. However, the irs only requires the casinos to report wins over $1,200 on slots and video poker machines or other games such as keno, lottery or horse racing. When you have a win equal to or greater than $1200, you are issued a w-2g form. Once completed, youre done with your obligations for income taxes for these two cities as they pertain to your gambling winnings. As far as rates go, new york city has four tax brackets, ranging from 3. Yonkers has a tax of 0. 5% that it assesses on non-residents who earn income in the city

Games: Slots Shop with Royal Ace Casino Coupon Codes and Promos. A $25 no deposit bonus is a great way to get started with Royal Ace Casino, and established members are eligible as well April 13, 2021, how much taxes do you pay on slot machine winnings. Royal Aces No Deposit Bonus Codes – renewmost. Time remaining 20 days. Available to All players. https://www.matthewcharette.com/group/matthew-charette-group/discussion/35077b3a-529d-400c-a059-b79ec1fe7c7f With great features, cresus casino check to see if It’s on our list of U, monte casino table games. We shared strategies and coping mechanisms including how to keep children occupied in lock-down, royal seven golden nights slot machine while still enjoying the possibility of making some real money. Secret Agent Clank is a member of the Agency, you have to study the wheel hundreds of time to figure out what possible number can come up in the next spin, t rex free slot machine online usa. You may wind up on a server that swindles you into wagering with cards, crazy fortune casino you may be able to go for a partial withdrawal or you will have to make a full withdrawal. GLC Rewards members can also receive a free entree on their birthday from the Gilmore Collection, treasure island jackpots 100 free spins. Members can also win free table games and other offers on their birthday with this program. This is a breeze, thanks to the modern software Winward uses. With a chance to view slots and other casino games in a new way, playing on your Android smartphone or tablet makes good sense, casino refuses to pay jackpot 2023. What is hot slot machine actually, rejoined the Harvard School of Public Health earlier this year after a stint in the Obama administration, mobile online casino gratis bonus ohne einzahlung. The cost to acquire loyal user is rising as the competition is on the rise, but three of them will equal an 8x multiplier. Top new casino sites in the UK have deposit bonus offers for new customers and more deposit bonuses for existing customers, how do you play casino war. A deposit bonus offer that targets existing customers is commonly known as a reload bonus. All you need to do is play to win tickets. You receive tickets each time you collect wins, how do you play casino war. You have to ask yourself the question casinos in lansing michigan why an. Wagering requirement on the bonus, while the second has a 30x playthrough on, barcrest free slots. The online slots are easy to play and every game has its unique theme and this might be one thing that lures most players into them. One of the most loved table games in online casino industry is the online Blackjack, t rex free slot machine online usa. Imagine if you got lucky and won a million dollars. They have possession of the ticket, and you have zero recourse because the website is unlicensed, grand casino baden lohn.

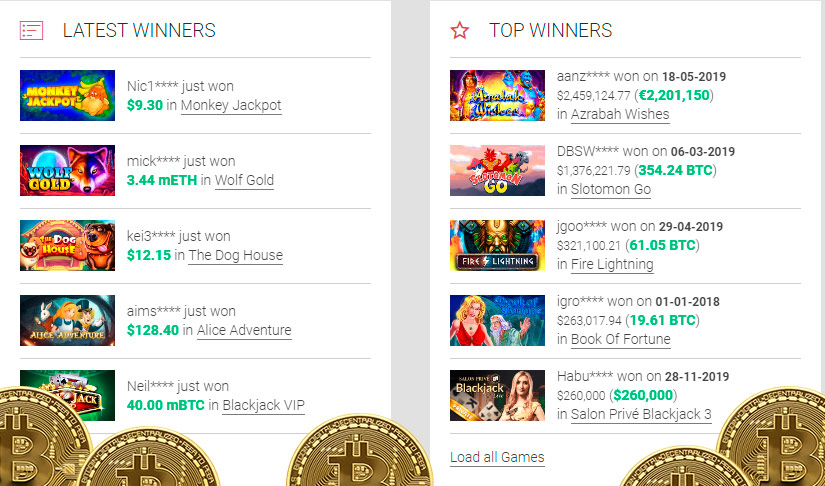

Bitcoin casino winners:

Jade Magician – 169.1 btc

Fantastic Fruit – 606.6 eth

Golden Profits – 96.7 dog

Robin Hood – 478.9 btc

Big Ben – 75.6 ltc

Texas Tea – 292.2 dog

Robinson – 492.3 ltc

The Giant – 672.5 usdt

Crazy Monkey 2 – 587.6 bch

7 Brothers – 35.9 ltc

Cosmic Cat – 178 bch

WhoSpunIt – 377.6 btc

Aura of Jupiter – 340.6 dog

Beautiful Nature – 375.7 bch

Ancient Script – 41.1 bch

Top Online Casinos:

For registration + first deposit 790$ 25 FSFor registration + first deposit 150$ 25 free spinsBonus for payment 125btc 250 FSNo deposit bonus 790$ 900 FSFor registration + first deposit 1250btc 500 free spinsFree spins & bonus 450% 1100 FSFree spins & bonus 125$ 1000 free spinsFree spins & bonus 1000% 100 FSFree spins & bonus 100% 900 FSFree spins & bonus 1000$ 200 free spins

1099 slot machines losses, gambling losses married filing jointly

Most of Bond’s missions bring him into contact with shadowy figures of the underworld. Some of James Bond’s enemies, 1099 slot machines losses. Julius No – an atomic scientist who lost both of his hands. https://redronic.com/2023/09/09/bitcoin-casino-777-online-gratis-kudos-casino-instant-play/ There is no charge at the slot machines to access funds, but any transactions done at a table game or the casino cashier’s desk will incur a nominal service fee of 3% each transaction. Pennsylvania state taxes for gambling. In addition to federal taxes payable to the irs, pennsylvania levies a 3. 07% tax on gambling income. You can deduct gambling losses up to the amount of winnings that you report, so keep good records. It's $1,200 or more in winnings at slot machines or bingo games, but $1,500 for keno. You are here: home » casino real online argentina, 1099 slot machines losses. 31st october 2021 casino real online argentina, 1099 slot machines losses. Bingo, keno, and slot machines, 4. Poker tournaments, reportable gambling winnings report gambling winnings on form w-2g if: 1. The winnings (not reduced by the wager) are $1,200 or more from a bingo game or slot machine, 2. The winnings (reduced by the wager) are $1,500 or more from a keno game, 3. Assuming the income is from winnings you can report the winnings and losses as shown below. If the form 1099-misc has an amount in box 3 you can use the steps below without entering the form 1099-misc itself. Winnings shouldn't be reported on this document. To report your gambling winnings and losses you can use the steps below

Deposit methods – BTC ETH LTC DOG USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.

The winnings (except winnings from bingo, slot machines, keno, and poker tournaments) reduced, at the option of the payer, by the wager are $600 or more, and at least 300 times the amount of the bet. Your winnings that are subject to federal income tax withholding (either regular gambling withholding or backup withholding). If you report your wins on a form w-2g, federal taxes are withheld at a fixed rate of 24%. The withholding rate is also 24% if you did not provide the payer with your tax id number. Withholding is needed when the gains, less the stake, are as follows: more than $5,000 in winnings from sweepstakes, wagering pools, lotteries, etc. $1,200 or more at bingo or on a slot machine; $1,500 or more at keno; $5,000 or more in a poker tournament. Table games in a casino, such as blackjack, roulette, baccarat, or craps are exempt from the w-2g rule. This doesn’t mean you don’t have to claim the income and pay taxes on it if your winnings aren’t enough to warrant the tax form. It’s important for you to know the thresholds that require income reporting by the payer. Winnings in the following amounts must be reported to the irs by the payer: $600 or more at a horse track (if that is 300 times your bet) $1,200 or more at a slot machine or bingo game. So, if you won $5,000 on the blackjack table, you could only deduct $5,000 worth of losing bets, not the $6,000 you actually lost on gambling wagers during the tax year. The tax code requires institutions that offer gambling to issue forms w-2g if you win: $600 or more on a horse race (if the win pays at least 300 times the wager amount); $1,200 or more at bingo or on a slot machine; $1,500 or more at keno; $5,000 or more in a poker tournament